This post was republished with permission from Zero Hedge

Gold is on a hot streak, up more than 50% to-date despite retreating from October’s record highs of $4,380 per troy ounce.

Driving global demand is the mixture of geopolitical tensions, a weaker U.S. dollar, and sticky inflation. In Q3 2025, central bank purchases were up 28% over the quarter, while inflows of gold-backed ETFs hit $26 billion.

This graphic, via Visual Capitalist’s Dorothy Neufeld, breaks down the total global supply of gold, both above and below ground, based on data from the World Gold Council.

All of the World’s Above and Below-Ground Gold

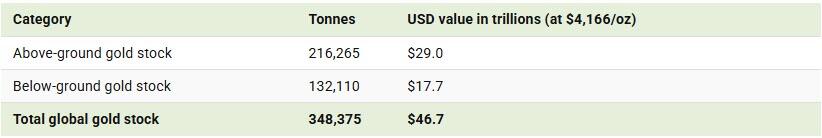

As of year-end 2024, the total above-ground stock of gold was 216,265 tonnes. Based on a gold price of $4,166 per troy ounce, all of the world’s mined gold is valued at $29 trillion.

When including identified underground gold, the total reaches 348,375 tonnes. All of the world’s gold together in a sphere would be about 107 feet tall, matching the approximate height of the White House from the south side’s lawn to the top of its flagpole.

The data table below breaks down all of the world’s above and below-ground gold and its value.

The world’s below-ground stock (gold that hasn’t been mined yet) is an estimated 132,110 tonnes, covering reserves and resources. Gold reserves are the part of underground gold resources (identified deposits) that are economically viable to extract at current prices.

Resources are not yet proven to be economically viable to mine and process.

How Much Gold is Left to Mine?

With most of the world’s gold already having been mined, only about 38% of the known gold supply remains underground, identified as reserves and resources.

At 2024’s pace of roughly 3,661 tonnes of gold production a year, that below-ground stock equates to just under four decades of additional output, assuming prices or technological advancements make resources economically feasible to mine in the future.

For investors, that mix of finite physical supply, ongoing central-bank purchases, and rising investment demand helps explain why this 107-foot sphere of gold now represents more than $47 trillion in combined above- and below-ground value at current prices.

To learn more about where the world’s gold is mined, check out this graphic which breaks down global gold production by region and country.

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

More news on our radar